The Ultimate Guide To Car Insurance Quotes

Wiki Article

Health Insurance - An Overview

Table of ContentsMedicaid Fundamentals ExplainedNot known Incorrect Statements About Health Insurance Some Ideas on Life Insurance You Need To KnowMedicaid Fundamentals Explained

You Might Want Disability Insurance Too "In contrast to what lots of people assume, their residence or vehicle is not their biggest possession. Instead, it is their capability to gain an earnings. Yet, lots of specialists do not insure the chance of an impairment," stated John Barnes, CFP and also proprietor of My Domesticity Insurance Coverage, in an email to The Balance.

The details below focuses on life insurance policy offered to individuals. Term Term Insurance policy is the simplest kind of life insurance.

The price per $1,000 of benefit boosts as the insured individual ages, and it obviously gets really high when the insured lives to 80 as well as past. The insurer could bill a premium that raises every year, but that would certainly make it very hard for lots of people to afford life insurance coverage at innovative ages.

The 3-Minute Rule for Insurance

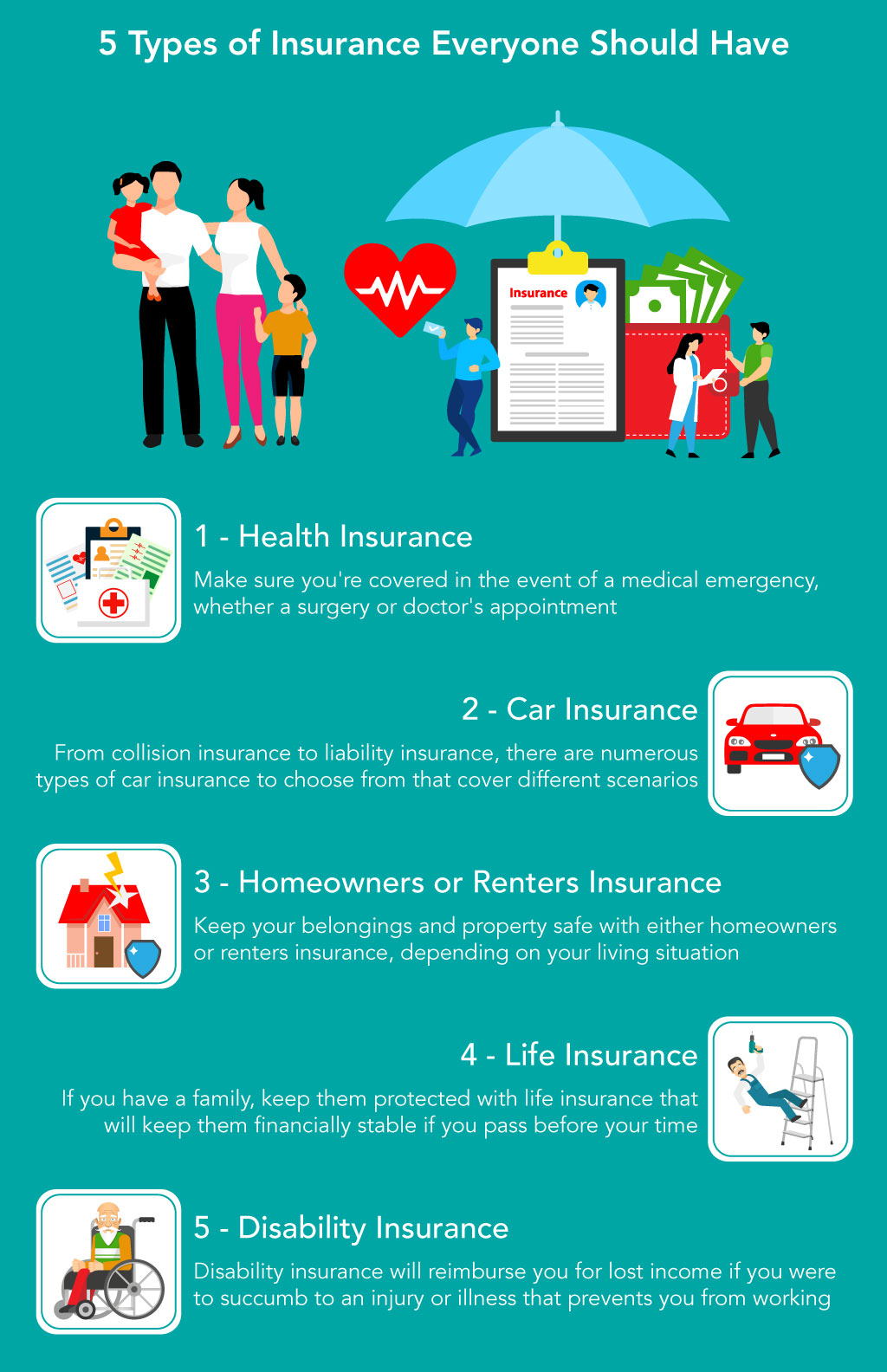

Insurance plan are made on the concept that although we can not stop regrettable events occurring, we can shield ourselves monetarily versus them. There are a huge number of various insurance plan offered on the market, and also all insurance firms try to convince us of the advantages of their certain product. Much so that it can be hard to choose which insurance plans are really needed, and which ones we can genuinely live without.Researchers have actually found that if the key breadwinner were to die their family members would only have the ability to cover their home expenses for just a couple of months; one in four households would certainly have problems covering their outgoings immediately. A lot of insurers suggest that you obtain cover for around ten times your annual earnings - health insurance.

You must additionally factor in childcare costs, and also future university charges if applicable. There are two major sorts of life insurance policy to pick from: whole life plans, and also term click to read more life policies. You pay for whole life policies up until you pass away, and also you spend for term life policies for a collection time period identified when you take out the policy.

Wellness Insurance, Medical Insurance is another one of the four main kinds of insurance that professionals advise. A recent research study exposed that sixty 2 percent of individual insolvencies in the United States in 2007 were as a straight outcome of health issue. A shocking seventy 8 percent of these filers had wellness insurance policy when their illness started.

Some Known Incorrect Statements About Cheap Car Insurance

Costs vary significantly according to your age, your existing state of health, and also your lifestyle. Even if it is not a lawful demand to take out car insurance where you live it is highly advised that you have some type of policy in location as you will certainly still have to think economic responsibility in the case of a mishap.Furthermore, your lorry is frequently among your most beneficial properties, and also if it is harmed in an accident you may have a hard time to spend for fixings, or for a substitute. You can additionally locate on your own liable for injuries suffered by your guests, or the chauffeur of an additional automobile, as well as for damages triggered to another vehicle as an outcome of your negligence.

General insurance policy covers residence, your traveling, vehicle, and also wellness (non-life properties) from fire, floodings, crashes, synthetic calamities, and also theft. Different kinds of basic insurance include motor insurance, health and wellness insurance coverage, travel insurance, and home insurance. A basic insurance plan pays for the losses that are sustained by the guaranteed during the period of the plan.

Continue reading to understand more concerning them: As the house is an useful ownership, it is crucial see it here to protect my response your home with a proper. Residence as well as household insurance policy protect your residence as well as the items in it. A residence insurance plan essentially covers synthetic and all-natural situations that may lead to damages or loss.

Not known Details About Renters Insurance

When your vehicle is liable for an accident, third-party insurance policy takes care of the damage caused to a third-party. It is additionally important to keep in mind that third-party motor insurance coverage is obligatory as per the Electric Motor Automobiles Act, 1988.

When it comes to health insurance coverage, one can decide for a standalone wellness policy or a family advance strategy that uses insurance coverage for all household members. Life insurance coverage supplies insurance coverage for your life.

Life insurance policy is various from basic insurance on different criteria: is a short-term agreement whereas life insurance policy is a lasting agreement. When it comes to life insurance policy, the advantages and also the sum guaranteed is paid on the maturation of the plan or in case of the policy owner's death.

They are however not obligatory to have. The general insurance coverage cover that is obligatory is third-party liability automobile insurance. This is the minimum insurance coverage that a vehicle should have before they can ply on Indian roads. Each and also every kind of general insurance coverage cover includes an objective, to use protection for a specific element.

Report this wiki page